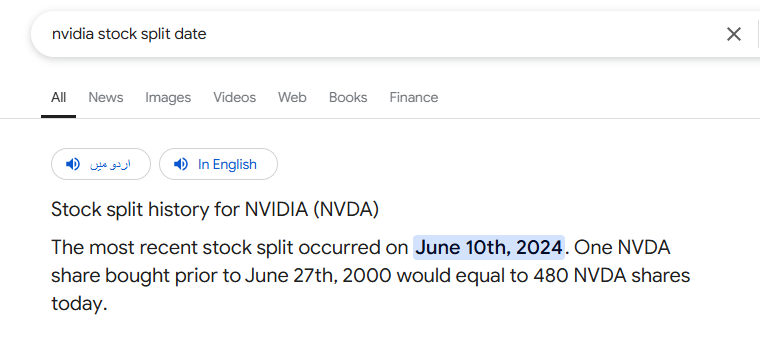

NVIDIA Stock Split Date

The last stock split that NVIDIA underwent was on July 20, 2021, which was the company’s fifth однишен split. Stock splits are often used to make shares more accessible to retail investors, increasing demand and liquidity. Rest does not affect the real value of the stocks because it doesn’t affect the market capitalization of the company.

Investors have speculated about whether another split looms. As NVIDIA’s valuation wavers, the company has not yet declared a new split date. If NVIDIA’s shares go too high, perhaps to attract those who can only buy shares in the hundreds of dollars, management may have to consider another split, advisors say.

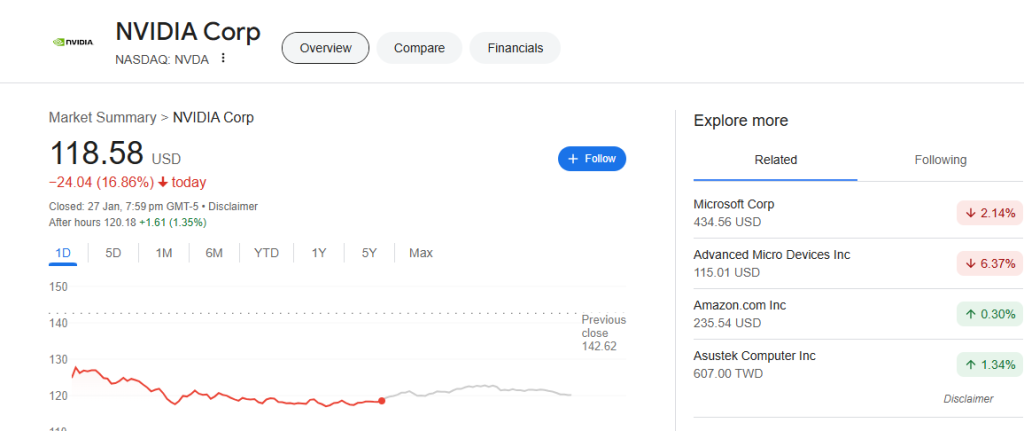

Should You Buy NVIDIA stock ?

NVIDIA is one of the most recognisable names in graphics processing units (GPUs) and artificial intelligence (AI). Although its stock price has taken a hit lately, it is still regarded as a long-term favorite by hundreds due to its fundamentals and potential going forward.

The decline may have been a result of market conditions, profit-taking, or macroeconomic factors such as increasing interest rates. But the company’s emphasis on artificial intelligence and cloud computing makes it well situated for future expansion. For potential buyers, the decline could either be seen as a buying opportunity, especially for anyone with a high risk tolerance and long-term horizon.

UBS Reiterates NVIDIA Buy Rating, $185 Price Target UBS Maintains NVIDIA Stock Buy Rating, $185 Price Target

Recently, UBS maintained its “Buy” rating on NVIDIA with a price target of $185 per share. This bullishness is attributed to NVIDIA’s robust revenue streams from data centers, gaming, and AI technologies.

Despite the volatility in the market, analysts at UBS think NVIDIA is a bargain at its current price point. The $185 target signals expectations of steady earnings growth in the coming quarters. While temporary fluctuations in near-term demand may lead some investors to the sidelines, this bullish view should create additional forward momentum for those who are willing to wait at least through 2023 to allow for an eventual recovery.