Bitcoin is once again making headlines—not just for its recent price surge, but for the uncertainty hanging over where it goes next.

After climbing from around $85,000 to a peak of $97,700 in just two weeks, the world’s most popular cryptocurrency is showing signs of slowing down, hovering around the $96,000 mark.

This has many in the crypto community asking: is this the start of a major rally, or just a short-lived spike before another dip?

The recent 4% price jump in the first couple of days of May certainly turned heads, but the broader market seems to be in consolidation mode right now, holding its breath for what comes next.

Could Bitcoin Drop to $50K? One Analyst Thinks So

A crypto analyst known as BALO on X (formerly Twitter) shared some insight on May 3 that’s been gaining traction.

Using a mix of Elliott Wave Theory and Fibonacci tools, he mapped out a scenario that could spell trouble for Bitcoin in the short term.

According to BALO, Bitcoin may have just completed wave 5 in its upward “impulse phase”—a pattern that often leads to a price correction, also known as the “pullback phase.”

In simple terms, this suggests that unless BTC breaks past a key resistance level at $102,000, it could be headed for a dip.

The Path to Recovery—or a Deeper Drop

If Bitcoin fails to reclaim $102,000, BALO believes we could see the beginning of a three-wave correction.

First would be a dip to around $70,000 (Wave A), followed by a temporary recovery back to $102,000 (Wave B), and then a deeper plunge to the $50,000-$60,000 range (Wave C).

But all hope isn’t lost. BALO adds that after this correction phase plays out, Bitcoin could be poised for another strong comeback, potentially rallying to a new high around $122,000.

Short-Term Optimism Amid Market Volatility

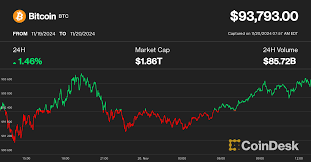

As of now, Bitcoin is trading at around $96,106, showing a modest 1.31% dip in the last 24 hours.

More notably, trading volume has plummeted by over 38%, which usually signals reduced investor activity or uncertainty.

Despite this, market sentiment still leans bullish.

According to analytics from Coincodex, investors remain greedy—suggesting they’re expecting prices to continue rising in the near future.

Price Predictions: Up, Then Down, Then Way Up?

Coincodex analysts are forecasting a mixed path ahead.

In the very near term, they expect Bitcoin to rise and possibly hit $119,528 within the next five days.

A month from now, their projection stands at $111,747.

But their three-month outlook is even more ambitious, predicting BTC could soar to around $136,026.

These predictions echo the general sentiment in the market: cautious optimism with a strong eye on technical indicators and key resistance levels.

Behind the Content: Editorial Standards That Matter

At Bitcoinist, the goal is to provide content that’s not only insightful but also reliable.

Every piece goes through a thorough review process, handled by industry experts and veteran editors.

The focus is always on accuracy, integrity, and making sure the information shared is both timely and trustworthy.